Market Maker

LHL Strategies, Inc. is the parent company of ClearLife Limited and its subsidiary, ClearLife LLC, and Lighthouse Life Capital LLC and its subsidiaries, Lighthouse Life Solutions, LLC, Lighthouse Life Direct, LLC, Harbor Life Settlements, LLC, Settlement Benefit Holdings, LLC (“Lighthouse Life” or the “Company). The Company is a vertically integrated provider of life policies and life policy services to longevity-risk asset managers and investors. The Company delivers value to consumers and investors through fast, efficient, and transparent life settlement transactions, and provides full lifecycle life policy services to asset investors worldwide.

Our Companies

Life Policy Origination

LHL advertises and markets to life insurance policyowners through multiple Direct-to-Consumer (DTC) brands, and markets to insurance and financial professionals (B2B) through the Lighthouse Life Settlement Advisor Program

Direct-to-Consumer (DTC)

Our Direct-to-Consumer (DTC) brands help seniors turn unwanted or unneeded life insurance policies into liquid assets they can use in any way they wish.

Business-to-Business (B2B)

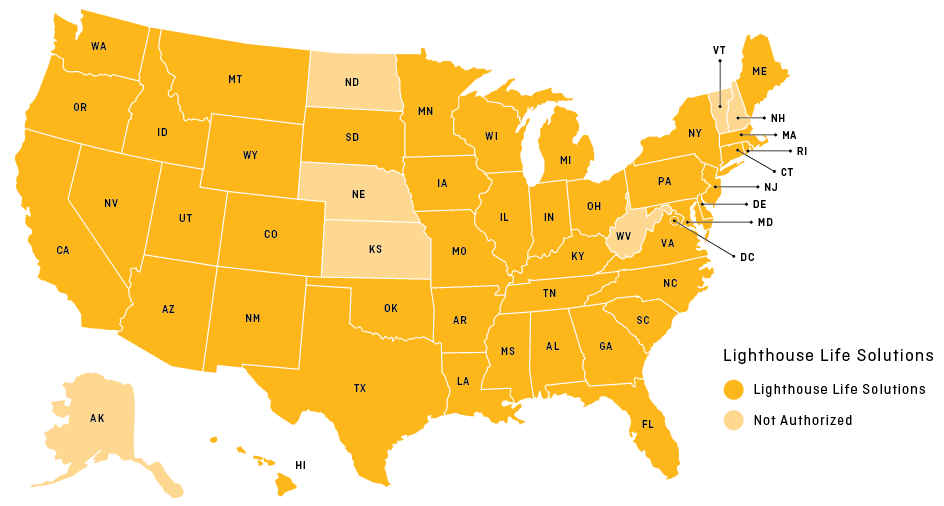

Lighthouse Life Solutions, our nationally licensed life settlement provider, works with insurance agents and financial advisors through the Lighthouse Life Settlement Advisor Program. This innovative program enables Agents and Advisors to offer life settlements to their senior clients by referring them to Lighthouse Life.

Some Advisor Program benefits include:

- No licensing required

- No reporting requirements for Advisors

- Lighthouse Life provides E&O coverage to Advisors and Firms

- A strong compliance focus, including our Suitability Questionnaire and Disclosures for Policyowners

Life Policy Acquisition

Life settlements are safe and secure transactions for seniors

- State licensing for life settlement providers (policy buyers)

- State Insurance Department approval of life settlement forms

- Extensive mandatory consumer disclosures

- Competency certification of seller/insured

Market Maker for Life Policies

Lighthouse Life is a trusted market maker, providing life policies acquired through life settlements to more than 30 active asset investors worldwide. The company works strategically to provide investors the assets and returns that meet their needs.

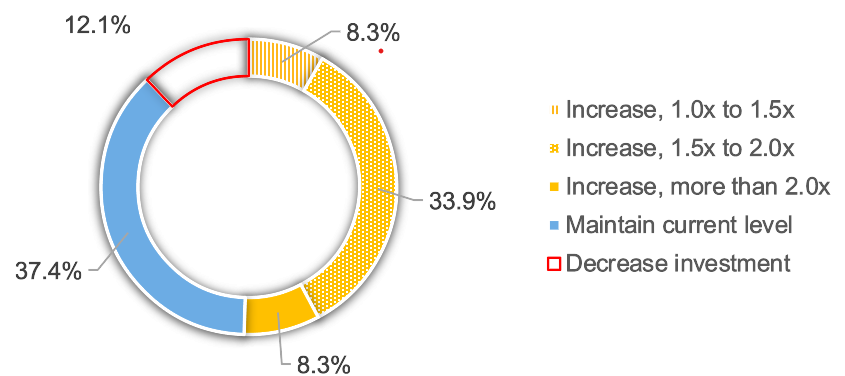

88% of current life settlements asset investors plan to maintain or increase their allocation in 2025

Reasons Investing in Life Settlements is an attractive alternative investment:

- Non-Correlation to Traditional Markets

- Predictable Returns

- Attractive Risk-Adjusted Yields

- Portfolio Diversification

- Tangible Asset-Backed Investment

- Demographic Tailwinds

- Socially Responsible Investment

- Potential for Long-Term Stability

ClearLife, founded in 2007 by Mark Venn, who was joined by Chris Stuart in 2008, is the dominant platform for longevity-risk market participants to value, trade and service life insurance products. ClearLife’s flagship software product, ClariNet, is a web-based, flexible, SaaS platform that streamlines operations and enhances decision-making related to life policies and portfolios. ClearLife also provides bespoke software and consultancy services for asset managers and other financial services companies in the life insurance and longevity risk markets.

Pricing & Valuation

- Pricing and valuation of policies and portfolios

- NPC and IRR calculations for individual transactions and life policy portfolios

- Customized reporting

Management & Portfolio Consulting

- Individual policy and portfolio management

- Consultation on acquisition and trading strategies

Policy Servicing

- Premium tracking and patments

- Updating medical records and insured tracking

- Updating policy statements

- Death benefit processing

Why Work With Us?

Vertically Integrated

Our full suite of services allows LHL Strategies to operate efficiently at every stage of the policy lifecycle, from origination to resale and ongoing servicing.

Technology Focused

We leverage both proven and emerging technologies to identify, capture, and deliver value at every touchpoint to every stakeholder.

Deep Experience

Our leadership team has over 100 years of life settlement industry experience, ranging from helping to create every major piece of life settlement legislation to the integration of Machine Learning (ML) and Artificial Intelligence (AI) into the business of life settlements.

Why Work With Us?

Vertically Integrated

Our full suite of services allows LHL Strategies to operate efficiently at every stage of the policy lifecycle, from origination to resale and ongoing servicing.

Technology Focused

We leverage both proven and emerging technologies to identify, capture, and deliver value at every touchpoint to every stakeholder.

Deep Experience

Our leadership team has over 100 years of life settlement industry experience, ranging from helping to create every major piece of life settlement legislation to the integration of Machine Learning (ML) and Artificial Intelligence (AI) into the business of life settlements.

Leadership Team

Michael Freedman

Founder and Chief Executive Officer, Chairman of the Board

Adam Lippman

Chief Operating Officer

Charles Portz

Chief Financial Officer

Noam Weiss

Chief Business Officer